capital gains tax canada real estate

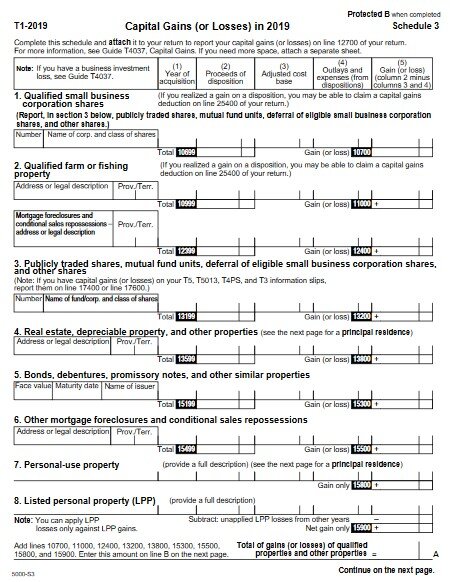

Use Schedule 3 Capital gains or losses to calculate and report all your capital gains and losses. When you own real estate that is not your principal residence youll likely run into capital gains tax somewhere down the road.

Real Estate Commissions Are Tax Deductible Mike Stewart

When you sell a property that youve lived in for at least two of the last five years you qualify for the homeowner exemption also known as the Section 121 exclusion for real estate.

. Do not include any capital gains or losses in your business or property income even if you. You may have to report a capital gain if you change your principal residence to a rental or business property or vice versa. Long-term capital gains are 0 15 or 20.

For instance if you buy a property. In Canada the capital gain inclusion rate is 50 which means when a capital asset is sold for more than it was paid for the CRA applies a tax on half 50 of the capital gain. 05 of the value up to and including 55000.

In this calculation 4 is the CCA rate for Class 1 properties and. The sale price minus your ACB is the capital gain that youll need to pay tax on. Even someone with a high income will only pay 27 tax at most on their capital gains 54 top tax rate in Nova Scotia times 50 inclusion rate.

10 of the value from 55000 to 250000. You must pay taxes on 50 of this gain at your marginal tax rate. 1300 yonge street suite 100 toronto ontario m4t 1x3.

Those with incomes above 501601 will find themselves getting hit with a 20 long-term capital gains rate. If you earned a capital gain of 10000 on an investment 5000 of that is taxable. Tax Partners is well respected among investors and lenders that rely on our independent accounting and tax services involving financial statements of our real estate clients.

Real estate includes the following. The US tax rates applicable to long term capital gain gain on capital property owned for more than 12 months are generally 15 or 20 there are technically 3 tax brackets on capital gains. When filing your American taxes you must complete.

Does capital gains tax apply only to real estate. Rental property both land and buildings farm property including both land and buildings other than qualified farm or fishing property. Chestnut park real estate limited brokerage.

Sale of farm property that includes a principal residence Only. You pay this tax one time when you purchase a property in Ontario. Multiply 5000 by the tax.

Thus the maximum possible CCA for Johns rental income would be 135000704½1890. When you sell a capital property for more than you paid for it this is called a capital gain. If the above is correct you only pay capital gains on 50 of that and at the tax bracket applicable to your total income for the year.

We sat down with Gary Li CPA CA to clarify the. Whether the property was used as a vacation home or principal residence. Below is how the federal tax brackets break down for the 2021 tax year.

Your tax rate is 0 on long-term capital gains if youre a single filer. In Canada 50 of the value of any capital gains is taxable. So 50 of 435k 2175k 33.

The CRA can charge capital gains tax on anything you sell that makes a profit including stocks bonds real estate. In our example you would have to include 1325.

Pay Less Tax On Your Capital Gains The Independent Dollar

How To Avoid Capital Gains Tax On Rental Property In Canada Edmontonrealestatelaw Ca

How Is Capital Gains Tax Calculated On Real Estate In Canada Accounting Firm Toronto Gta Accounting Professional Corporation

I Am A Non Resident And I Am Selling My Rental Property In Canada Grant Matossian Cga Cfp

6 3 Explanation And Interpretation Of Article Vi Under U S Law Canada U S Tax Treaty Tax Professionals Member Article By The Accounting And Tax

New Tax Rules For Canadian Controlled Private Corporations Madan Ca

How Inheriting A House Works In Canada

Capital Gains 101 How To Calculate Transactions In Foreign Currency

How To Avoid The Capital Gains Tax On Rental Property In Canada

As Home Sale Prices Surge A Tax Bill May Follow The New York Times

Selling Property Abroad And U S Taxes H R Block

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Kalfa Law Capital Gains Exemption 2020 Capital Gains Tax

6 Capital Gains Tax Myths Debunked Zolo

Selling Stock How Capital Gains Are Taxed The Motley Fool

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

Capital Gains Tax In Canada Explained

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

:max_bytes(150000):strip_icc()/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png)